Financial professionals add value by keeping their clients informed of the value of their assets, especially when they are searching for ways to increase funds for medical, retirement, or other expenses. The truth is that these clients could be sitting on a financial asset considered very valuable in the secondary life insurance market—a universal life, whole life, or even term life insurance policy that they no longer need.

However, many advisors are unfamiliar with the secondary market for life insurance, and often believe their clients’ only option for a policy they no longer need is to let it lapse or surrender to the insurance company.

So, what is the secondary market for life insurance, and how can your clients benefit from it?

The secondary market for life insurance

The primary life insurance market involves insurance policies that originate through a transaction between an insurance company and the policyowner. In the secondary market, individuals or companies purchase existing life insurance policies from policyowners. In this transaction, the policyowner sells an in-force but unwanted or unneeded insurance policy to a third-party buyer for a lump-sum cash payment.

There are two core types of transactions in the secondary market: life settlements and viatical settlements. Life settlements are generally reserved for insureds over the age of 65, while viatical settlements are only available to insureds who have been diagnosed with a terminal illness.

You can find more information on eligibility for a viatical settlement in our policyowner Guide to Viatical Settlements

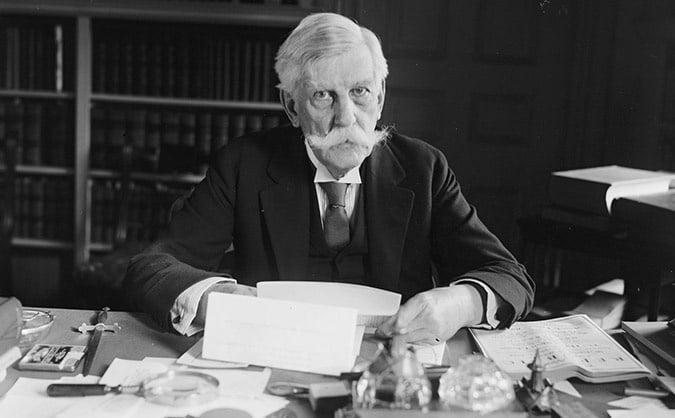

Both life settlements and viatical settlements allow policyowners to exercise their legal right to sell a life insurance policy. More than a century ago, the US Supreme Court unanimously established that life insurance policies enjoy the “ordinary characteristics of property,” which includes the right to sell a policy in an open market.

“To deny the right to sell except to persons having such an [insurable] interest is to diminish appreciably the value of the contract in the owner’s hands.” Justice Oliver Wendell Holmes, Grigsby v. Russell, 222 U.S. 149 (1911)

Since that ruling in 1911, life settlements and viatical settlements have enabled policyowners to extract value from an asset that would otherwise have gone unrealized.

While the secondary market remains largely unknown to many policyowners, it can be a great source for advisors to help generate liquidity for their clients. Oftentimes, the settlement funds are used to help solve for medical and long term care expenses or retirement planning, but there are no limits on what the funds can be used toward.

Benefits of a life settlement or viatical settlement include (but are not limited to):

- Generates a large, lump-sum payment: In many cases, a settlement through the secondary market results in a payout higher than the policy’s cash surrender value—an average of four or more times more. As their clients’ financial champion, exploring and realizing a policy’s value in the secondary market is a safe and lucrative recommendation for financial advisors to make.

- Eliminates a recurring expense: After the sale, the seller’s financial responsibility for maintaining the policy is eliminated, and the buyer/new policyowner is responsible for all future premium payments—even if the seller retains a portion of the benefit. Therefore, in addition to the significant cash payout received by the seller, their ongoing expenses associated with the policy are reduced to $0. Particularly for expensive and/or high face value policies, this can result in a six-figure net change to annual income and expenses and can go a long way in helping clients adequately budget for their financial futures.

- Converts an old investment into “found money”: The policy a client purchased years ago may no longer suit their lifestyle or needs. Rather than paying for an unneeded policy or surrendering for its cash value, a life settlement or viatical settlement can turn a locked-in cost into a larger cash payout to be used to meet the client’s immediate or long-term financial needs.

If a life settlement or viatical settlement through the secondary market could help your clients access income they would otherwise have missed out on, you don’t have to navigate the process alone. Lighthouse Life is your trusted source in the secondary market—providing financial professionals with the expertise and compliance-oriented processes to help deliver the best value possible to their clients. Contact us today or use our Life Settlement Calculator for Advisors to start the conversation.